Is Your Startup Built to IPO? Understanding TAM, ACVs, and GTM

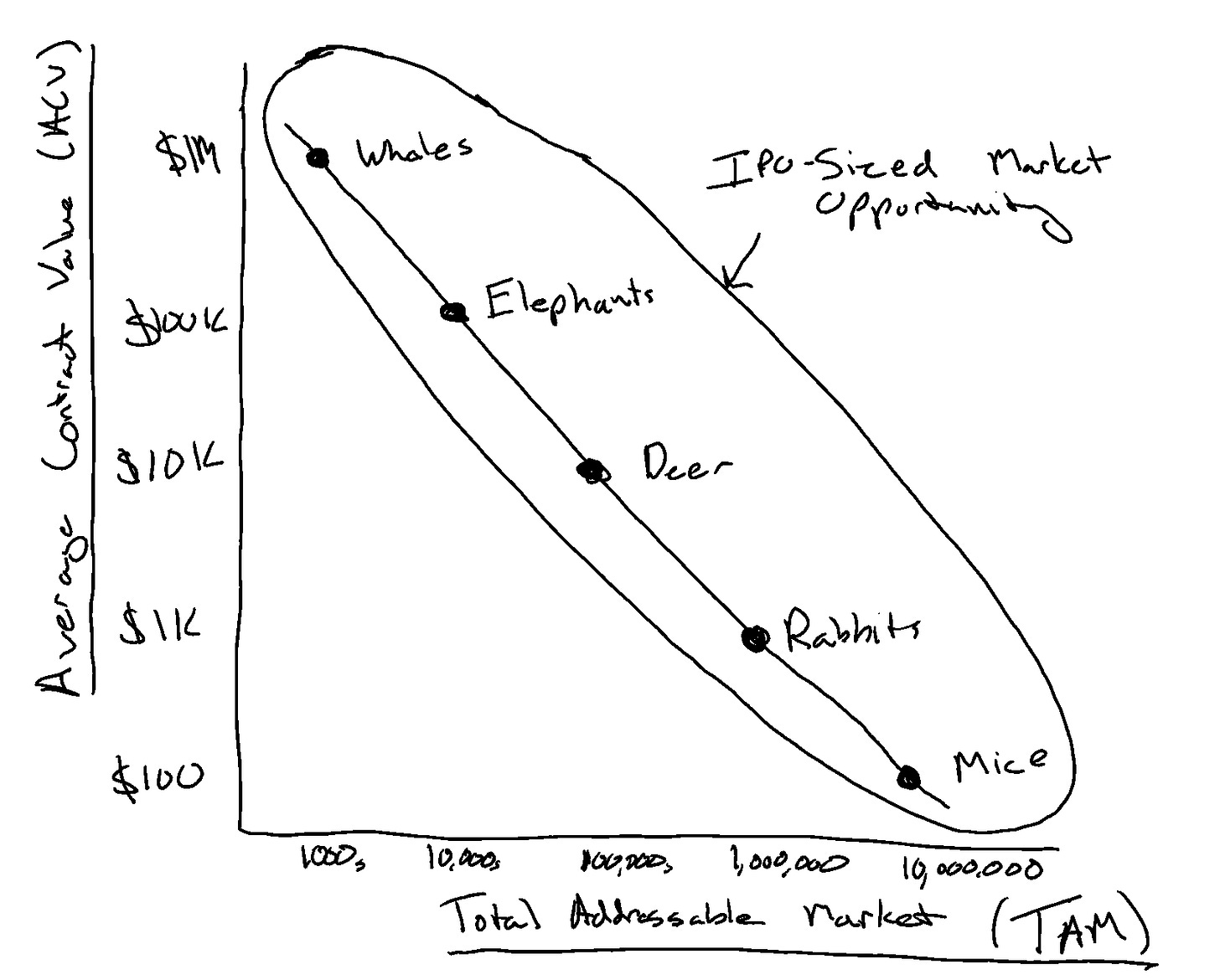

A “rule of thumb” approach to evaluate what average contract values (ACVs), total addressable markets (TAM), and go to market (GTM) is required to build an IPO-able company

For any founder evaluating a new startup idea, determining whether a market is "big enough" is crucial. This aspect is often ignored by founders in the customer discovery process, but is undoubtedly one of the biggest determinants of long term success.

The most common way to analyze market size is by a 3rd party market research report that provides a top down market size analysis. I find those reports to be misleading especially for startups which are often creating new markets. Instead, I have a simpler mental model.

First, what is an IPO-sized market opportunity? Today, to go public you need $200M+ in revenue. Further, market leading companies often only get to 10-15% market share. So that means, for example, if you have 2,000 companies in your total addressable market and execute really well, you might land 200 of these companies in 8-10 years. Therefore, in order to go public, you need $1M+ deals.

Following this logic, I’ve outlined a “rule of thumb” approach to evaluate what average contract values (ACVs), total addressable markets (TAM), and go to market (GTM) is required to build an IPO-able company. By understanding these “physics”, you can make informed decisions about your startup’s eventual IPO-able potential.

When assessing the potential of your B2B startup idea, consider the following guidelines:

Whales:

TAM: 1000s

ACV: $1M+

GTM: Enterprise Field AEs w/ $300-350K OTE and $1.5-$2.0M quotas

Elephants:

TAM: 10,000s

ACV: $100K+

GTM: Enterprise Hybrid Inside / Field AEs w/ $250-$325K OTE and $1.0-$1.2M quotas

Deer:

TAM: 100,000s

ACV: $10K+

GTM: Inside AEs w/ $150-$250K OTE and $500-$800K quotas

Rabbits:

TAM: 1,000,000s

ACV: $1K+

GTM: Self Serve w/ Inside AEs w/ $100K OTE and $300K quotas

Mice:

TAM: 10,000,000s

ACV: $100+

GTM: Self Serve w/ No AEs

By understanding the “physics” of your startup, including the TAM, ACVs, and GTM approach, you can better assess whether your company has the potential to IPO one day. Note, there are many, many caveats to this rule of thumb, but my hope is it can provide a useful framework for founders.